CRISIL has assigned 'BB-/Stable' on the bank loan facilities of Ugar Sugar Works. The rating continues to reflect the benefits that Ugar Sugar derives from its management's extensive industry experience and its integrated manufacturing facilities.

These rating strengths are partially offset by the company's below-average financial risk profile, marked by a high gearing and weak debt protection metrics, and susceptibility to adverse regulatory changes in the sugar industry.

These rating strengths are partially offset by the company's below-average financial risk profile, marked by a high gearing and weak debt protection metrics, and susceptibility to adverse regulatory changes in the sugar industry.

CRISIL believes that Ugar Sugar's financial risk profile will remain constrained by its weak capital structure amid large working capital requirements coupled with constrained operating profitability over the near term. The outlook may be revised to 'Positive' if there is improvement in Ugar Sugar's financial risk profile backed by higher than expected profitability leading to improved gearing levels.

Conversely, the outlook may be revised to 'Negative' if Ugar Sugar's accruals are lower than envisaged, or if the company undertakes any larger-than-expected debt-funded capex programme deteriorating its financial risk profile.

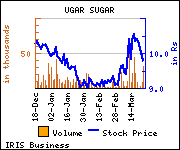

Shares of the company gained Rs 0.33, or 3.38%, to settle at Rs 10.10. The total volume of shares traded was 12,656 at the BSE (Thursday).